|

| NASCAR Cup Series and Indy 500 viewership. Click to enlarge. |

I have excluded the Daytona 500 from Fox's Cup Series average because it has almost twice the audience of the second-most-viewed Cup race. Still, Fox's NASCAR coverage has more viewers than NBC's, both over-the-air and on cable.

Fox carries momentum from Daytona during the early season and a declining viewership during the season is a trend in NASCAR's TV ratings. Half of the NBC portion of the NASCAR season takes place once the football season has started, hurting NBC's ratings. Although the playoffs were introduced to create excitement into the late season clashing with football, the playoff races' ratings are still down on the summer races on NBC and NBCSN.

The overall trend was NASCAR's TV ratings going down. The average audience for the over-the-air telecasts on Fox was down 7 percent (including Daytona) and on NBC down 6 percent on 2016. On cable, the average audience was down 11 percent on both FS1 and NBCSN.

Comparable averages, different characteristics for INDYCAR, F1, NHRA audience

Not only the Monster Energy Cup Series is the most-viewed motorsports series in American television but also the Xfinity Series gets more viewers than any non-NASCAR series. I have split the Camping World Truck Series on FS1 into spring and fall parts to make it comparable with the other two NASCAR series where the season is split between Fox in the spring and NBC in the fall. The spring and fall averages of the Truck Series showcase the momentum NASCAR has after the Daytona Speedweeks and the struggle during the football season.

|

| Xfinity, Trucks, INDYCAR, F1, and NHRA OTA audience. |

|

| Xfinity, Trucks, INDYCAR, F1, and NHRA cable audience. |

The two open-wheel categories, INDYCAR and Formula One, are natural rivals, although they also complement each other and have a somewhat overlapping fanbase.

On free-to-air channels, the Verizon IndyCar Series races outside the 500 were usually in the same territory with F1 in TV ratings. However, 2017 was a bad year for INDYCAR on ABC with a 16-percent decline in the audience (excluding the Indy 500 and its qualifications). F1 on NBC has been split into two in the diagram above because the NFL usually hurts the fall races' audience. Still, the U.S. Grand Prix had 1.0 million viewers, up 45 percent from 2016, while the Mexican GP the following week had 825 thousand viewers, only marginally above the 2016 audience.

On cable, INDYCAR attracts slightly more viewers than F1. There are certain different characteristics in the viewership of those two series. While F1 consistently draws an audience between 500 and 600 thousand viewers for almost all the races in the European time zones, INDYCAR's audience varies more from race to race.

INDYCAR's viewership peaks between June and the end of August. That's a period when three major leagues, NFL, NBA, and NHL, are having the offseason. INDYCAR's higher peak of audience may be because it's more familiar of a series for the American audience plus afternoon races attract more casual viewers than F1 races in early Sunday morning.

On the other hand, apart from some Asian races in the middle of the night, F1 hardly ever gets as low TV ratings as INDYCAR sometimes gets. Maybe F1 has a more dedicated fanbase in the USA than INDYCAR's. Also, F1 races early in the morning don't usually clash with other major sports events.

I have split NHRA on FS1 into spring and fall averages because of the big difference in viewership. Until June, most NHRA races are shown tape-delayed after the NASCAR Cup race. The NASCAR lead-in allowed NHRA to attract the biggest cable audience for a non-NASCAR series and also above the NASCAR Trucks' audience. On the other hand, the viewership drops to under half of the early season once NHRA on FS1 goes opposite to NASCAR on NBC's channels and the NFL starts in September.

NHRA was the only series showing growth both over-the-air and on cable in 2017, although it was minimal. On Fox, NHRA's OTA audience was comparable to that of INDYCAR's.

Formula One has the youngest audience

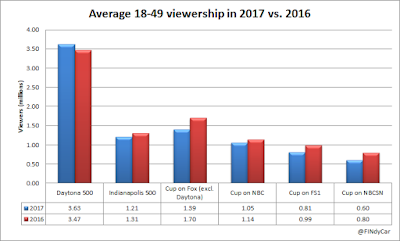

Unsurprisingly the Monster Energy NASCAR Cup Series is the leading motorsports series also in the 18-49 age group, and the Daytona 500 is clearly the most-viewed race also in that age group. However, the decline the 18-49 audience is even more rapid than in the total audience. The average 18-49 audience for the over-the-air telecasts on Fox was down 12 percent (including Daytona) and on NBC down 18 percent on 2016. On cable, the the decline was even more drastic with the average 18-49 audience down 18 percent on FS1 and 24 percent on NBCSN.

|

| NASCAR Cup Series and Indy 500 viewership in the 18-49 age group. |

If the Indy 500 attracted just under half of the total audience of the Daytona 500, the gap is even bigger in the 18-49 age group where Indy attracts only one third of Daytona's 18-49 audience. The age structure of the NASCAR Cup Series' fanbase looks slightly better than INDYCAR's: the 18-49 age group makes up 25 percent of the Cup Series' total audience during the season, for INDYCAR it's 22 percent. And while the Daytona 500 attracts young people more than other races with the 18-49 audience making up 30 percent of the total audience, for the Indy 500 it's only 22 percent. INDYCAR is struggling to attract younger generations as the viewership also for other races shows.

|

| Xfinity, Trucks, INDYCAR, F1, and NHRA OTA audience in the 18-49 group. |

|

| Xfinity, Trucks, INDYCAR, F1, and NHRA cable audience in the 18-49 group. |

If INDYCAR's total audience outside the 500 has been comparable to F1's audience, that's not the case in the 18-49 age group. INDYCAR lost 25 percent of its 18-49 audience on ABC in 2017, making it the least-viewed series on OTA channels in that age group. Despite the overall growth of the audience on NBCSN, INDYCAR also lost cable audience in the 18-49 group.

F1 has a positive outlook in America. It may be a niche sport in the USA but it has a young audience with the 18-49 age group making up 31 percent of the total audience. The Monaco and Canadian Grands Prix already averaged above the NASCAR Xfinity Series on OTA channels in 18-49 audience and F1 on NBCSN was in the territory of the Truck Series' viewership.

NHRA's viewership in the 18-49 age group drops more drastically when it loses the NASCAR lead-in on FS1. The 18-49 group makes up 24 percent of the total audience of the spring races on FS1 whereas they make up only 20 percent in the fall. That implies the younger audience are more of casual viewers that stay on the channel after the NASCAR race.

While a few series showed increased 18-49 viewership on the OTA networks, all series' cable viewership decreased in the 18-49 group. Cord cutting may be behind the decreased 18-49 cable viewership. Young adults don't want to pay for channels they don't have time to watch because of family and work reasons. If anything, they opt for streaming services they can watch on mobile devices wherever they are, and whenever they want, thanks to video-on-demand.

INDYCAR and F1 battling for the leading open-wheel series' status

NASCAR has been America's leading motorsport in the 00s and 10s, however it's losing fans as its star drivers are retiring and the racing is not as good as it used to be. And while the NASCAR management is trying to make the sport more exciting, the rule changes are dividing the fanbase and driving some fans away. Still, I don't expect any series to challenge NASCAR's leading position in America any time soon, so big is NASCAR's fanbase.

F1 has a positive outlook in America. While it's been losing viewership worldwide this decade, it's been growing in the USA and it has the youngest fanbase of major motorsports in the USA. Younger generations are more open towards global, traditionally non-American sports like soccer or Formula One, and the Internet allows them to follow the news even if the sport is not mainstream in the USA.

F1 will not be a direct rival for NASCAR, they are two totally different categories. NASCAR is as American as it gets, F1 is global. The two categories have a different target audience. And even though the American owners of F1 want to expand F1's footprint in the USA and add races there, most of the races will still take place in Europe or Asia in difficult time zones for the American audience.

F1 will face a challenge in the USA next year as it moves from NBC to ESPN. On NBC F1 was cross-promoted with the group's INDYCAR and NASCAR coverage, for ESPN the only motorsports programming is the five INDYCAR races on ABC. INDYCAR's decreasing viewership on ABC as opposed to the solid ratings on NBCSN does not look too promising F1 on ESPN.

INDYCAR has been trying to get back the fans it lost during its split years, and it has succeeded in growing its cable audience during the last few years. Still, it's been more about growing its core audience. The OTA audience, especially for the 500, has been down, implying INDYCAR struggles to attract casual viewers.

INDYCAR has an old fanbase, partly because the split years cost it younger generations. Attracting young fans is the most important thing for INDYCAR's future. If the current 18-49 viewership translates into the future overall viewership, INDYCAR will no longer be the leading alternative to NASCAR but a second-tier open-wheel series to F1 even in the American media. INDYCAR needs to outperform its rivals in social media and other media that young people consume.

There is no easy way to improve TV ratings, apart from a better TV deal and avoiding bad time slots. INDYCAR already has an on-track product second to none. Although I'm writing about the TV ratings, I think it's the live race experience that can drive up INDYCAR's popularity. INDYCAR needs more events like Long Beach, Road America, Gateway, and of course the 500; well-attended events that are more than races and can become known nationwide. INDYCAR currently lacks a bit of the feel of a major series; well-attended events would give it the impression of something big.

It would be especially great for INDYCAR if there were more oval races. Ovals offer a product that could appeal also to NASCAR fans and offer the kind of thrill that even F1, the pinnacle of motorsports, lacks.

I think INDYCAR with its US-centered schedule has more potential than F1 to become truly mainstream in the States. Then again, if the younger generations choose F1 over INDYCAR and NASCAR remains relatively popular, then there may be no space for INDYCAR as a high-profile series outside the 500.

Numbers via Awful Announcing, Showbuzz Daily, and Sports Media Watch.

The numbers don't include streaming services, thus may differ from the numbers announced by the broadcasters. Rain-delayed races excluded from averages if delayed until Monday. Tape delays included besides live telecasts for races shown live on a secondary channel (e.g. CNBC) and F1 races shown live before 8am.

No comments:

Post a Comment