The frustration of INDYCAR's international fan base about not being able to watch the Indianapolis 500 practice sessions (in official ways) has made me think about the future of INDYCAR's international broadcasting. In this text I will explain why I think an international streaming platform operated by INDYCAR's American broadcasting partner would be the best solution.

In the USA, a traditional TV-based broadcasting model is still very much a must for INDYCAR. Free-to-air coverage, like the Indy 500 and seven other races get, is still the best display window for the sport despite streaming platforms challenging the linear television.

However, INDYCAR is unlikely to get free-to-air coverage almost everywhere outside the States. It may get some occasional new viewers on the pay-per-view sports channels it is on, however the cost of those pay channels also prevents some fans from watching the series. Also, there are even countries where there are no (official) ways to watch INDYCAR. A (reasonably-priced) international streaming platform would enable reaching those fans INDYCAR has overseas.

It might not make sense for INDYCAR to set up their own international streaming platform, especially as they couldn't use it in America where their biggest following is. INDYCAR needs a mainstream broadcasting partner in the USA; they couldn't reach a similar audience there by only streaming the races.

The most sensible solution might be selling the international streaming rights together with the American rights. The American broadcaster would be mandated to offer an all-inclusive streaming package outside the USA. It shouldn't be too difficult for the American broadcaster to offer the international streaming. They are already producing the coverage and they already have the technology for a streaming platform. All they'd have to do is to monetize the international interest in INDYCAR.

I'd see this as an ideal solution for the international broadcasting of INDYCAR. This way fans from around the world could enjoy all the content the American broadcaster offers to the American fans. Given Indy car racing's overseas status as a niche sport, hardly any international broadcaster is going to put as much effort into their INDYCAR coverage as the American broadcaster does.

Of course, TV coverage can still help to reach new viewers who wouldn't subscribe to a streaming service. Also, local broadcasters can provide commentary in local languages as opposed to an international stream in English. Even if there was a streaming package, INDYCAR should still look for overseas TV partners. A streaming package doesn't necessarily rule out TV deals. As an example, the ATP Tour, where INDYCAR's CEO Mark Miles has a background, has its Tennis TV streaming package available globally. That still doesn't stop the ATP making local broadcasting deals with TV networks, many of which are also offering their own streaming services.

Showing posts with label broadcasting. Show all posts

Showing posts with label broadcasting. Show all posts

Friday, May 17, 2019

Wednesday, March 21, 2018

NBC contract promises good things for INDYCAR

INDYCAR and NBC Sports Group have announced a three-year broadcasting contract, bringing the entire Verizon IndyCar Series to NBC's platforms. The new contract will end the split coverage between ABC and NBCSN, the first of which had covered the Indianapolis 500 ever since 1965.

Under the new contract, NBC will broadcast eight races, including the Indy 500, free-to-air as opposed to five under the previous contract with ABC. According to an AP article, NBC will also broadcast the 500 qualifications free-to-air, like ABC has done. The rest of the races will be broadcast on NBC Sports Network on cable, and all races will be live streamed to authenticated subscribers on NBCSports.com and the NBC Sports app.

In addition to the coverage on NBC and NBCSN, NBC Sports Gold will offer a streaming package including the practice and qualifying sessions not shown live on TV as well as the Indy Lights races and full-event replays.

NBC becoming the sole broadcaster of INDYCAR is positive for a number of reasons. First of all, it will end the confusing split between two broadcasters. For example, the upcoming schedule shown in ABC's telecast from the season opener in St. Petersburg excluded the upcoming three races shown on NBCSN and listed only the Month of May shown on ABC.

Secondly, NBC has done superior work with their cable broadcasts compared to ABC's broadcasts. NBC's commentators have done better job than their colleagues on ABC and as have also NBC's TV directors. Not only that but they have also reserved more time for the pre- and postrace coverage on NBCSN and have even televised some practice and qualifying sessions unlike ABC.

Most importantly, NBC seems more committed to covering INDYCAR than ABC and ESPN have been. I can't watch the American broadcasters here in Finland but as far as I know, ABC has done little to promote their INDYCAR coverage. For example, during the season-opening St. Petersburg weekend, I couldn't see any mention about INDYCAR on ABC or ESPN's Twitter accounts. On the other hand, NBC provided updates also from that race despite not broadcasting it.

NBCSN has grown the audience of its INDYCAR cable broadcasts by 78 percent since 2013. Meanwhile the growth of INDYCAR's free-to-air audience has stalled on ABC and the Indy 500 earned its lowest TV rating ever last year. It was time to move away from ABC.

I believe NBC can take the INDYCAR coverage to a new level. Not only their broadcasts have been superior to ABC's but they also appear to be more committed to covering the sport. ABC and ESPN have done little to cover the series besides fulfilling the broadcasting commitments as opposed to NBC whose motorsports department provides updates from the sport also between the races.

The increased number of races that will be shown free-to-air will increase the reach of the series and is also a promising sign of the state of INDYCAR. The Indy 500 will be a part of NBC's Championship Season alongside other sports' marquee events and should get the attention it deserves. NBC has already revived the Kentucky Derby's TV ratings after years of decline on ABC. The 500 is in a similar situation now, going from ABC to NBC.

As opposed to the previous six-year contract with ABC and ten-year contract with NBCSN (previously Versus), this new NBC contract is only three years. I think having a short contract now can be a good thing for INDYCAR as the media landscape is undergoing some big changes. Also, there are so many positive things around INDYCAR now that in three years the series can be in an even better position for the contract negotiations.

What is new in the new broadcasting contract is NBC's coverage from all practice and qualifying sessions on NBC Sports Gold. That will apparently be the end of the free streaming of those sessions on YouTube, though the wording of the announcement implies some of them may possibly be televised. The NBC Sports Gold package will also include full-event replays, which I hope won't be the end of race uploads on YouTube. That would be a step backwards, especially when also NASCAR uploads their races to YouTube.

This NBC Sports Gold package is probably NBC and INDYCAR dipping their toes into over-the-top offering, though mostly this is NBC offering the content that doesn't fit their TV channels' programming. This package still doesn't answer the demand to offer an alternative for cable subscription, like MotoGP does with the Videopass and now also F1 with the F1 TV OTT service.

Over-the-top services are challenging the traditional business model of sports broadcasters. People don't want to pay for cable channels if there is a less expensive way to watch exactly what they want to see. There are surely fans without a cable subscription who would subscribe to an all-inclusive INDYCAR OTT package. Then again, even a cable channel can be a great display window for INDYCAR to reach those people who wouldn't subscribe to the OTT package. Last year NBCSN reached 71 percent of American households, though the trend of cord cutting may bring that number down considerably in the near future.

The way I see the future of INDYCAR broadcasting, broadcast television will remain an effective media long into the future to reach and gain fans. It's important to have a high number of races shown free-to-air. Though the increasing rate of cord cutting will reduce the potential reach of the cable broadcasts. After this new contract will have expired in 2021, I hope INDYCAR will offer an all-inclusive OTT package to reach those fans without a cable subscription, instead of losing them to F1 and other series which have one.

For an OTT service, I think a platform like NBC Sports Gold would be better for INDYCAR than an own service. Using an existing platform wouldn't require investing in an own platform and the OTT package could be integrated in the broadcaster's INDYCAR offering. Being affiliated with a broadcaster has certain valuable benefits, like the coverage across the broadcaster's different platforms and cross-promotion in other programming.

Of course, it may be difficult to convince a broadcaster offering an OTT alternative for the cable subscription. The OTT offering for 2019 is still protecting the traditional business model where you need a cable subscription to see the races on NBCSN. However, that model may not have much life left; people will find something alternative to watch. Broadcasters are missing potential customers by not offering OTT packages specific to certain content. Starting to offer that kind of packages could be the traditional broadcasters' response to the new OTT services. Besides, in INDYCAR's case, an all-inclusive OTT package could also open new possibilities as that broadcaster's platform could also be used for the international streaming.

Just like the current national broadcasting contract with ABC and NBCSN expires at the end of this year, so does also the international broadcasting contract with ESPN International. ESPN International has shown INDYCAR on their local channels around the world or distributed the rights to third parties plus. ESPN Player has offered streaming of the races in Europe, Middle East, and Africa apart from certain regions with local broadcasters.

NBC Sports Gold offers some packages also for overseas viewers so that could be an international streaming platform if the American OTT package were expanded with race coverage. However, compared to ESPN, NBCUniversal doesn't have appropriate TV channels for INDYCAR outside the USA so it seems unlikely for the international broadcasting partner, unless they acquired those rights only for redistributing them and offering NBC Sports Gold for streaming.

Although ESPN and ABC won't broadcast INDYCAR in the USA after this year, ESPN International may still be a strong candidate for the international broadcasting partner. ESPN's numerous international channels show also sports they have no broadcasting rights in the USA.

However, I think there's lots of room for improvement in ESPN International's INDYCAR coverage. ESPN Player hasn't shown the pre- or postrace coverage of the NBCSN broadcasts, neither have they shown those practice or qualifying sessions that were on NBCSN and thus not in YouTube. Whatever broadcaster INDYCAR chooses as the international distributor, I hope they will be required to show all sessions of the race weekends, preferably including NBC's pre- and postrace coverage or offering their own.

I'm not sure selling the international broadcasting rights to a single distributor is ideal for INDYCAR. INDYCAR has no control over which channels the distributor will sell the regional rights to. A third party selling the TV rights isn't thinking about the growth of the sport the way INDYCAR is.

When I think about appropriate overseas broadcasters, BT Sport is doing great job in the UK. Their broadcasting rights obviously come from their affiliation with ESPN, though regardless of the international broadcasting partner, they would be a great broadcaster for INDYCAR also in the upcoming seasons. BT Sport isn't just broadcasting the world feed, instead they have British commentators on air when their American colleagues are on a commercial break. If anything, simulcasting the BT Sport broadcast would be ideal for any broadcaster with no commercial breaks.

When I think about Europe in general, I'd like to see Eurosport broadcasting INDYCAR like they did in the CART era. They already have series like Formula E, FIA WEC, WorldSBK, and WTCR, so INDYCAR could complement Eurosports motorsports offering. In addition to their two main channels, Eurosport Player allows additional streams for other live events. If the races were shown on the main channel, Eurosport Player's additional channels could stream the practice and qualifying sessions.

Besides, Eurosport's parent Discovery owns free-to-air channels across Europe which were used to fulfill the local free-to-air requirements of the Olympic coverage. Here in Finland, Discovery uses those channels also to show tennis' Grand Slam finals in addition to the full coverage on Eurosport, and I think they might do the same with the Indy 500. And while Eurosport is available across Europe, they have somewhat different programming in different countries, depending on the local TV rights. INDYCAR could sell the British TV rights to BT Sport while the rest of Europe could watch it on Eurosport.

Those are just some potential European broadcasters for INDYCAR. I think it would be better for the series to sell the TV rights directly to broadcasters, instead of selling them to a global distributor.

Under the new contract, NBC will broadcast eight races, including the Indy 500, free-to-air as opposed to five under the previous contract with ABC. According to an AP article, NBC will also broadcast the 500 qualifications free-to-air, like ABC has done. The rest of the races will be broadcast on NBC Sports Network on cable, and all races will be live streamed to authenticated subscribers on NBCSports.com and the NBC Sports app.

In addition to the coverage on NBC and NBCSN, NBC Sports Gold will offer a streaming package including the practice and qualifying sessions not shown live on TV as well as the Indy Lights races and full-event replays.

NBC becoming the sole broadcaster of INDYCAR is positive for a number of reasons. First of all, it will end the confusing split between two broadcasters. For example, the upcoming schedule shown in ABC's telecast from the season opener in St. Petersburg excluded the upcoming three races shown on NBCSN and listed only the Month of May shown on ABC.

Secondly, NBC has done superior work with their cable broadcasts compared to ABC's broadcasts. NBC's commentators have done better job than their colleagues on ABC and as have also NBC's TV directors. Not only that but they have also reserved more time for the pre- and postrace coverage on NBCSN and have even televised some practice and qualifying sessions unlike ABC.

Most importantly, NBC seems more committed to covering INDYCAR than ABC and ESPN have been. I can't watch the American broadcasters here in Finland but as far as I know, ABC has done little to promote their INDYCAR coverage. For example, during the season-opening St. Petersburg weekend, I couldn't see any mention about INDYCAR on ABC or ESPN's Twitter accounts. On the other hand, NBC provided updates also from that race despite not broadcasting it.

NBCSN has grown the audience of its INDYCAR cable broadcasts by 78 percent since 2013. Meanwhile the growth of INDYCAR's free-to-air audience has stalled on ABC and the Indy 500 earned its lowest TV rating ever last year. It was time to move away from ABC.

I believe NBC can take the INDYCAR coverage to a new level. Not only their broadcasts have been superior to ABC's but they also appear to be more committed to covering the sport. ABC and ESPN have done little to cover the series besides fulfilling the broadcasting commitments as opposed to NBC whose motorsports department provides updates from the sport also between the races.

The increased number of races that will be shown free-to-air will increase the reach of the series and is also a promising sign of the state of INDYCAR. The Indy 500 will be a part of NBC's Championship Season alongside other sports' marquee events and should get the attention it deserves. NBC has already revived the Kentucky Derby's TV ratings after years of decline on ABC. The 500 is in a similar situation now, going from ABC to NBC.

As opposed to the previous six-year contract with ABC and ten-year contract with NBCSN (previously Versus), this new NBC contract is only three years. I think having a short contract now can be a good thing for INDYCAR as the media landscape is undergoing some big changes. Also, there are so many positive things around INDYCAR now that in three years the series can be in an even better position for the contract negotiations.

NBC Sports Gold complements coverage but doesn't replace cable yet

What is new in the new broadcasting contract is NBC's coverage from all practice and qualifying sessions on NBC Sports Gold. That will apparently be the end of the free streaming of those sessions on YouTube, though the wording of the announcement implies some of them may possibly be televised. The NBC Sports Gold package will also include full-event replays, which I hope won't be the end of race uploads on YouTube. That would be a step backwards, especially when also NASCAR uploads their races to YouTube.

This NBC Sports Gold package is probably NBC and INDYCAR dipping their toes into over-the-top offering, though mostly this is NBC offering the content that doesn't fit their TV channels' programming. This package still doesn't answer the demand to offer an alternative for cable subscription, like MotoGP does with the Videopass and now also F1 with the F1 TV OTT service.

Over-the-top services are challenging the traditional business model of sports broadcasters. People don't want to pay for cable channels if there is a less expensive way to watch exactly what they want to see. There are surely fans without a cable subscription who would subscribe to an all-inclusive INDYCAR OTT package. Then again, even a cable channel can be a great display window for INDYCAR to reach those people who wouldn't subscribe to the OTT package. Last year NBCSN reached 71 percent of American households, though the trend of cord cutting may bring that number down considerably in the near future.

The way I see the future of INDYCAR broadcasting, broadcast television will remain an effective media long into the future to reach and gain fans. It's important to have a high number of races shown free-to-air. Though the increasing rate of cord cutting will reduce the potential reach of the cable broadcasts. After this new contract will have expired in 2021, I hope INDYCAR will offer an all-inclusive OTT package to reach those fans without a cable subscription, instead of losing them to F1 and other series which have one.

For an OTT service, I think a platform like NBC Sports Gold would be better for INDYCAR than an own service. Using an existing platform wouldn't require investing in an own platform and the OTT package could be integrated in the broadcaster's INDYCAR offering. Being affiliated with a broadcaster has certain valuable benefits, like the coverage across the broadcaster's different platforms and cross-promotion in other programming.

Of course, it may be difficult to convince a broadcaster offering an OTT alternative for the cable subscription. The OTT offering for 2019 is still protecting the traditional business model where you need a cable subscription to see the races on NBCSN. However, that model may not have much life left; people will find something alternative to watch. Broadcasters are missing potential customers by not offering OTT packages specific to certain content. Starting to offer that kind of packages could be the traditional broadcasters' response to the new OTT services. Besides, in INDYCAR's case, an all-inclusive OTT package could also open new possibilities as that broadcaster's platform could also be used for the international streaming.

What will happen with international TV rights?

Just like the current national broadcasting contract with ABC and NBCSN expires at the end of this year, so does also the international broadcasting contract with ESPN International. ESPN International has shown INDYCAR on their local channels around the world or distributed the rights to third parties plus. ESPN Player has offered streaming of the races in Europe, Middle East, and Africa apart from certain regions with local broadcasters.

NBC Sports Gold offers some packages also for overseas viewers so that could be an international streaming platform if the American OTT package were expanded with race coverage. However, compared to ESPN, NBCUniversal doesn't have appropriate TV channels for INDYCAR outside the USA so it seems unlikely for the international broadcasting partner, unless they acquired those rights only for redistributing them and offering NBC Sports Gold for streaming.

Although ESPN and ABC won't broadcast INDYCAR in the USA after this year, ESPN International may still be a strong candidate for the international broadcasting partner. ESPN's numerous international channels show also sports they have no broadcasting rights in the USA.

However, I think there's lots of room for improvement in ESPN International's INDYCAR coverage. ESPN Player hasn't shown the pre- or postrace coverage of the NBCSN broadcasts, neither have they shown those practice or qualifying sessions that were on NBCSN and thus not in YouTube. Whatever broadcaster INDYCAR chooses as the international distributor, I hope they will be required to show all sessions of the race weekends, preferably including NBC's pre- and postrace coverage or offering their own.

I'm not sure selling the international broadcasting rights to a single distributor is ideal for INDYCAR. INDYCAR has no control over which channels the distributor will sell the regional rights to. A third party selling the TV rights isn't thinking about the growth of the sport the way INDYCAR is.

When I think about appropriate overseas broadcasters, BT Sport is doing great job in the UK. Their broadcasting rights obviously come from their affiliation with ESPN, though regardless of the international broadcasting partner, they would be a great broadcaster for INDYCAR also in the upcoming seasons. BT Sport isn't just broadcasting the world feed, instead they have British commentators on air when their American colleagues are on a commercial break. If anything, simulcasting the BT Sport broadcast would be ideal for any broadcaster with no commercial breaks.

When I think about Europe in general, I'd like to see Eurosport broadcasting INDYCAR like they did in the CART era. They already have series like Formula E, FIA WEC, WorldSBK, and WTCR, so INDYCAR could complement Eurosports motorsports offering. In addition to their two main channels, Eurosport Player allows additional streams for other live events. If the races were shown on the main channel, Eurosport Player's additional channels could stream the practice and qualifying sessions.

Besides, Eurosport's parent Discovery owns free-to-air channels across Europe which were used to fulfill the local free-to-air requirements of the Olympic coverage. Here in Finland, Discovery uses those channels also to show tennis' Grand Slam finals in addition to the full coverage on Eurosport, and I think they might do the same with the Indy 500. And while Eurosport is available across Europe, they have somewhat different programming in different countries, depending on the local TV rights. INDYCAR could sell the British TV rights to BT Sport while the rest of Europe could watch it on Eurosport.

Those are just some potential European broadcasters for INDYCAR. I think it would be better for the series to sell the TV rights directly to broadcasters, instead of selling them to a global distributor.

Tuesday, December 12, 2017

How do other series compare against NASCAR's TV audience?

The Monster Energy NASCAR Cup Series is the leading motorsports series in the American television and the only series averaging over two million viewers. The only non-NASCAR race in the same territory of viewership is the Indianapolis 500, attracting an audience above the average of the NASCAR Cup Series but still less the half of that of NASCAR's flagship race, the Daytona 500.

I have excluded the Daytona 500 from Fox's Cup Series average because it has almost twice the audience of the second-most-viewed Cup race. Still, Fox's NASCAR coverage has more viewers than NBC's, both over-the-air and on cable.

Fox carries momentum from Daytona during the early season and a declining viewership during the season is a trend in NASCAR's TV ratings. Half of the NBC portion of the NASCAR season takes place once the football season has started, hurting NBC's ratings. Although the playoffs were introduced to create excitement into the late season clashing with football, the playoff races' ratings are still down on the summer races on NBC and NBCSN.

The overall trend was NASCAR's TV ratings going down. The average audience for the over-the-air telecasts on Fox was down 7 percent (including Daytona) and on NBC down 6 percent on 2016. On cable, the average audience was down 11 percent on both FS1 and NBCSN.

Not only the Monster Energy Cup Series is the most-viewed motorsports series in American television but also the Xfinity Series gets more viewers than any non-NASCAR series. I have split the Camping World Truck Series on FS1 into spring and fall parts to make it comparable with the other two NASCAR series where the season is split between Fox in the spring and NBC in the fall. The spring and fall averages of the Truck Series showcase the momentum NASCAR has after the Daytona Speedweeks and the struggle during the football season.

The two open-wheel categories, INDYCAR and Formula One, are natural rivals, although they also complement each other and have a somewhat overlapping fanbase.

On free-to-air channels, the Verizon IndyCar Series races outside the 500 were usually in the same territory with F1 in TV ratings. However, 2017 was a bad year for INDYCAR on ABC with a 16-percent decline in the audience (excluding the Indy 500 and its qualifications). F1 on NBC has been split into two in the diagram above because the NFL usually hurts the fall races' audience. Still, the U.S. Grand Prix had 1.0 million viewers, up 45 percent from 2016, while the Mexican GP the following week had 825 thousand viewers, only marginally above the 2016 audience.

On cable, INDYCAR attracts slightly more viewers than F1. There are certain different characteristics in the viewership of those two series. While F1 consistently draws an audience between 500 and 600 thousand viewers for almost all the races in the European time zones, INDYCAR's audience varies more from race to race.

INDYCAR's viewership peaks between June and the end of August. That's a period when three major leagues, NFL, NBA, and NHL, are having the offseason. INDYCAR's higher peak of audience may be because it's more familiar of a series for the American audience plus afternoon races attract more casual viewers than F1 races in early Sunday morning.

On the other hand, apart from some Asian races in the middle of the night, F1 hardly ever gets as low TV ratings as INDYCAR sometimes gets. Maybe F1 has a more dedicated fanbase in the USA than INDYCAR's. Also, F1 races early in the morning don't usually clash with other major sports events.

I have split NHRA on FS1 into spring and fall averages because of the big difference in viewership. Until June, most NHRA races are shown tape-delayed after the NASCAR Cup race. The NASCAR lead-in allowed NHRA to attract the biggest cable audience for a non-NASCAR series and also above the NASCAR Trucks' audience. On the other hand, the viewership drops to under half of the early season once NHRA on FS1 goes opposite to NASCAR on NBC's channels and the NFL starts in September.

NHRA was the only series showing growth both over-the-air and on cable in 2017, although it was minimal. On Fox, NHRA's OTA audience was comparable to that of INDYCAR's.

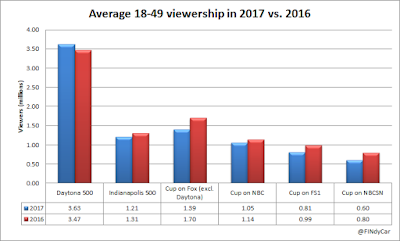

Unsurprisingly the Monster Energy NASCAR Cup Series is the leading motorsports series also in the 18-49 age group, and the Daytona 500 is clearly the most-viewed race also in that age group. However, the decline the 18-49 audience is even more rapid than in the total audience. The average 18-49 audience for the over-the-air telecasts on Fox was down 12 percent (including Daytona) and on NBC down 18 percent on 2016. On cable, the the decline was even more drastic with the average 18-49 audience down 18 percent on FS1 and 24 percent on NBCSN.

If the Indy 500 attracted just under half of the total audience of the Daytona 500, the gap is even bigger in the 18-49 age group where Indy attracts only one third of Daytona's 18-49 audience. The age structure of the NASCAR Cup Series' fanbase looks slightly better than INDYCAR's: the 18-49 age group makes up 25 percent of the Cup Series' total audience during the season, for INDYCAR it's 22 percent. And while the Daytona 500 attracts young people more than other races with the 18-49 audience making up 30 percent of the total audience, for the Indy 500 it's only 22 percent. INDYCAR is struggling to attract younger generations as the viewership also for other races shows.

If INDYCAR's total audience outside the 500 has been comparable to F1's audience, that's not the case in the 18-49 age group. INDYCAR lost 25 percent of its 18-49 audience on ABC in 2017, making it the least-viewed series on OTA channels in that age group. Despite the overall growth of the audience on NBCSN, INDYCAR also lost cable audience in the 18-49 group.

F1 has a positive outlook in America. It may be a niche sport in the USA but it has a young audience with the 18-49 age group making up 31 percent of the total audience. The Monaco and Canadian Grands Prix already averaged above the NASCAR Xfinity Series on OTA channels in 18-49 audience and F1 on NBCSN was in the territory of the Truck Series' viewership.

NHRA's viewership in the 18-49 age group drops more drastically when it loses the NASCAR lead-in on FS1. The 18-49 group makes up 24 percent of the total audience of the spring races on FS1 whereas they make up only 20 percent in the fall. That implies the younger audience are more of casual viewers that stay on the channel after the NASCAR race.

While a few series showed increased 18-49 viewership on the OTA networks, all series' cable viewership decreased in the 18-49 group. Cord cutting may be behind the decreased 18-49 cable viewership. Young adults don't want to pay for channels they don't have time to watch because of family and work reasons. If anything, they opt for streaming services they can watch on mobile devices wherever they are, and whenever they want, thanks to video-on-demand.

NASCAR has been America's leading motorsport in the 00s and 10s, however it's losing fans as its star drivers are retiring and the racing is not as good as it used to be. And while the NASCAR management is trying to make the sport more exciting, the rule changes are dividing the fanbase and driving some fans away. Still, I don't expect any series to challenge NASCAR's leading position in America any time soon, so big is NASCAR's fanbase.

F1 has a positive outlook in America. While it's been losing viewership worldwide this decade, it's been growing in the USA and it has the youngest fanbase of major motorsports in the USA. Younger generations are more open towards global, traditionally non-American sports like soccer or Formula One, and the Internet allows them to follow the news even if the sport is not mainstream in the USA.

F1 will not be a direct rival for NASCAR, they are two totally different categories. NASCAR is as American as it gets, F1 is global. The two categories have a different target audience. And even though the American owners of F1 want to expand F1's footprint in the USA and add races there, most of the races will still take place in Europe or Asia in difficult time zones for the American audience.

F1 will face a challenge in the USA next year as it moves from NBC to ESPN. On NBC F1 was cross-promoted with the group's INDYCAR and NASCAR coverage, for ESPN the only motorsports programming is the five INDYCAR races on ABC. INDYCAR's decreasing viewership on ABC as opposed to the solid ratings on NBCSN does not look too promising F1 on ESPN.

INDYCAR has been trying to get back the fans it lost during its split years, and it has succeeded in growing its cable audience during the last few years. Still, it's been more about growing its core audience. The OTA audience, especially for the 500, has been down, implying INDYCAR struggles to attract casual viewers.

INDYCAR has an old fanbase, partly because the split years cost it younger generations. Attracting young fans is the most important thing for INDYCAR's future. If the current 18-49 viewership translates into the future overall viewership, INDYCAR will no longer be the leading alternative to NASCAR but a second-tier open-wheel series to F1 even in the American media. INDYCAR needs to outperform its rivals in social media and other media that young people consume.

There is no easy way to improve TV ratings, apart from a better TV deal and avoiding bad time slots. INDYCAR already has an on-track product second to none. Although I'm writing about the TV ratings, I think it's the live race experience that can drive up INDYCAR's popularity. INDYCAR needs more events like Long Beach, Road America, Gateway, and of course the 500; well-attended events that are more than races and can become known nationwide. INDYCAR currently lacks a bit of the feel of a major series; well-attended events would give it the impression of something big.

It would be especially great for INDYCAR if there were more oval races. Ovals offer a product that could appeal also to NASCAR fans and offer the kind of thrill that even F1, the pinnacle of motorsports, lacks.

I think INDYCAR with its US-centered schedule has more potential than F1 to become truly mainstream in the States. Then again, if the younger generations choose F1 over INDYCAR and NASCAR remains relatively popular, then there may be no space for INDYCAR as a high-profile series outside the 500.

Numbers via Awful Announcing, Showbuzz Daily, and Sports Media Watch.

The numbers don't include streaming services, thus may differ from the numbers announced by the broadcasters. Rain-delayed races excluded from averages if delayed until Monday. Tape delays included besides live telecasts for races shown live on a secondary channel (e.g. CNBC) and F1 races shown live before 8am.

|

| NASCAR Cup Series and Indy 500 viewership. Click to enlarge. |

I have excluded the Daytona 500 from Fox's Cup Series average because it has almost twice the audience of the second-most-viewed Cup race. Still, Fox's NASCAR coverage has more viewers than NBC's, both over-the-air and on cable.

Fox carries momentum from Daytona during the early season and a declining viewership during the season is a trend in NASCAR's TV ratings. Half of the NBC portion of the NASCAR season takes place once the football season has started, hurting NBC's ratings. Although the playoffs were introduced to create excitement into the late season clashing with football, the playoff races' ratings are still down on the summer races on NBC and NBCSN.

The overall trend was NASCAR's TV ratings going down. The average audience for the over-the-air telecasts on Fox was down 7 percent (including Daytona) and on NBC down 6 percent on 2016. On cable, the average audience was down 11 percent on both FS1 and NBCSN.

Comparable averages, different characteristics for INDYCAR, F1, NHRA audience

Not only the Monster Energy Cup Series is the most-viewed motorsports series in American television but also the Xfinity Series gets more viewers than any non-NASCAR series. I have split the Camping World Truck Series on FS1 into spring and fall parts to make it comparable with the other two NASCAR series where the season is split between Fox in the spring and NBC in the fall. The spring and fall averages of the Truck Series showcase the momentum NASCAR has after the Daytona Speedweeks and the struggle during the football season.

|

| Xfinity, Trucks, INDYCAR, F1, and NHRA OTA audience. |

|

| Xfinity, Trucks, INDYCAR, F1, and NHRA cable audience. |

The two open-wheel categories, INDYCAR and Formula One, are natural rivals, although they also complement each other and have a somewhat overlapping fanbase.

On free-to-air channels, the Verizon IndyCar Series races outside the 500 were usually in the same territory with F1 in TV ratings. However, 2017 was a bad year for INDYCAR on ABC with a 16-percent decline in the audience (excluding the Indy 500 and its qualifications). F1 on NBC has been split into two in the diagram above because the NFL usually hurts the fall races' audience. Still, the U.S. Grand Prix had 1.0 million viewers, up 45 percent from 2016, while the Mexican GP the following week had 825 thousand viewers, only marginally above the 2016 audience.

On cable, INDYCAR attracts slightly more viewers than F1. There are certain different characteristics in the viewership of those two series. While F1 consistently draws an audience between 500 and 600 thousand viewers for almost all the races in the European time zones, INDYCAR's audience varies more from race to race.

INDYCAR's viewership peaks between June and the end of August. That's a period when three major leagues, NFL, NBA, and NHL, are having the offseason. INDYCAR's higher peak of audience may be because it's more familiar of a series for the American audience plus afternoon races attract more casual viewers than F1 races in early Sunday morning.

On the other hand, apart from some Asian races in the middle of the night, F1 hardly ever gets as low TV ratings as INDYCAR sometimes gets. Maybe F1 has a more dedicated fanbase in the USA than INDYCAR's. Also, F1 races early in the morning don't usually clash with other major sports events.

I have split NHRA on FS1 into spring and fall averages because of the big difference in viewership. Until June, most NHRA races are shown tape-delayed after the NASCAR Cup race. The NASCAR lead-in allowed NHRA to attract the biggest cable audience for a non-NASCAR series and also above the NASCAR Trucks' audience. On the other hand, the viewership drops to under half of the early season once NHRA on FS1 goes opposite to NASCAR on NBC's channels and the NFL starts in September.

NHRA was the only series showing growth both over-the-air and on cable in 2017, although it was minimal. On Fox, NHRA's OTA audience was comparable to that of INDYCAR's.

Formula One has the youngest audience

Unsurprisingly the Monster Energy NASCAR Cup Series is the leading motorsports series also in the 18-49 age group, and the Daytona 500 is clearly the most-viewed race also in that age group. However, the decline the 18-49 audience is even more rapid than in the total audience. The average 18-49 audience for the over-the-air telecasts on Fox was down 12 percent (including Daytona) and on NBC down 18 percent on 2016. On cable, the the decline was even more drastic with the average 18-49 audience down 18 percent on FS1 and 24 percent on NBCSN.

|

| NASCAR Cup Series and Indy 500 viewership in the 18-49 age group. |

If the Indy 500 attracted just under half of the total audience of the Daytona 500, the gap is even bigger in the 18-49 age group where Indy attracts only one third of Daytona's 18-49 audience. The age structure of the NASCAR Cup Series' fanbase looks slightly better than INDYCAR's: the 18-49 age group makes up 25 percent of the Cup Series' total audience during the season, for INDYCAR it's 22 percent. And while the Daytona 500 attracts young people more than other races with the 18-49 audience making up 30 percent of the total audience, for the Indy 500 it's only 22 percent. INDYCAR is struggling to attract younger generations as the viewership also for other races shows.

|

| Xfinity, Trucks, INDYCAR, F1, and NHRA OTA audience in the 18-49 group. |

|

| Xfinity, Trucks, INDYCAR, F1, and NHRA cable audience in the 18-49 group. |

If INDYCAR's total audience outside the 500 has been comparable to F1's audience, that's not the case in the 18-49 age group. INDYCAR lost 25 percent of its 18-49 audience on ABC in 2017, making it the least-viewed series on OTA channels in that age group. Despite the overall growth of the audience on NBCSN, INDYCAR also lost cable audience in the 18-49 group.

F1 has a positive outlook in America. It may be a niche sport in the USA but it has a young audience with the 18-49 age group making up 31 percent of the total audience. The Monaco and Canadian Grands Prix already averaged above the NASCAR Xfinity Series on OTA channels in 18-49 audience and F1 on NBCSN was in the territory of the Truck Series' viewership.

NHRA's viewership in the 18-49 age group drops more drastically when it loses the NASCAR lead-in on FS1. The 18-49 group makes up 24 percent of the total audience of the spring races on FS1 whereas they make up only 20 percent in the fall. That implies the younger audience are more of casual viewers that stay on the channel after the NASCAR race.

While a few series showed increased 18-49 viewership on the OTA networks, all series' cable viewership decreased in the 18-49 group. Cord cutting may be behind the decreased 18-49 cable viewership. Young adults don't want to pay for channels they don't have time to watch because of family and work reasons. If anything, they opt for streaming services they can watch on mobile devices wherever they are, and whenever they want, thanks to video-on-demand.

INDYCAR and F1 battling for the leading open-wheel series' status

NASCAR has been America's leading motorsport in the 00s and 10s, however it's losing fans as its star drivers are retiring and the racing is not as good as it used to be. And while the NASCAR management is trying to make the sport more exciting, the rule changes are dividing the fanbase and driving some fans away. Still, I don't expect any series to challenge NASCAR's leading position in America any time soon, so big is NASCAR's fanbase.

F1 has a positive outlook in America. While it's been losing viewership worldwide this decade, it's been growing in the USA and it has the youngest fanbase of major motorsports in the USA. Younger generations are more open towards global, traditionally non-American sports like soccer or Formula One, and the Internet allows them to follow the news even if the sport is not mainstream in the USA.

F1 will not be a direct rival for NASCAR, they are two totally different categories. NASCAR is as American as it gets, F1 is global. The two categories have a different target audience. And even though the American owners of F1 want to expand F1's footprint in the USA and add races there, most of the races will still take place in Europe or Asia in difficult time zones for the American audience.

F1 will face a challenge in the USA next year as it moves from NBC to ESPN. On NBC F1 was cross-promoted with the group's INDYCAR and NASCAR coverage, for ESPN the only motorsports programming is the five INDYCAR races on ABC. INDYCAR's decreasing viewership on ABC as opposed to the solid ratings on NBCSN does not look too promising F1 on ESPN.

INDYCAR has been trying to get back the fans it lost during its split years, and it has succeeded in growing its cable audience during the last few years. Still, it's been more about growing its core audience. The OTA audience, especially for the 500, has been down, implying INDYCAR struggles to attract casual viewers.

INDYCAR has an old fanbase, partly because the split years cost it younger generations. Attracting young fans is the most important thing for INDYCAR's future. If the current 18-49 viewership translates into the future overall viewership, INDYCAR will no longer be the leading alternative to NASCAR but a second-tier open-wheel series to F1 even in the American media. INDYCAR needs to outperform its rivals in social media and other media that young people consume.

There is no easy way to improve TV ratings, apart from a better TV deal and avoiding bad time slots. INDYCAR already has an on-track product second to none. Although I'm writing about the TV ratings, I think it's the live race experience that can drive up INDYCAR's popularity. INDYCAR needs more events like Long Beach, Road America, Gateway, and of course the 500; well-attended events that are more than races and can become known nationwide. INDYCAR currently lacks a bit of the feel of a major series; well-attended events would give it the impression of something big.

It would be especially great for INDYCAR if there were more oval races. Ovals offer a product that could appeal also to NASCAR fans and offer the kind of thrill that even F1, the pinnacle of motorsports, lacks.

I think INDYCAR with its US-centered schedule has more potential than F1 to become truly mainstream in the States. Then again, if the younger generations choose F1 over INDYCAR and NASCAR remains relatively popular, then there may be no space for INDYCAR as a high-profile series outside the 500.

Numbers via Awful Announcing, Showbuzz Daily, and Sports Media Watch.

The numbers don't include streaming services, thus may differ from the numbers announced by the broadcasters. Rain-delayed races excluded from averages if delayed until Monday. Tape delays included besides live telecasts for races shown live on a secondary channel (e.g. CNBC) and F1 races shown live before 8am.

Tuesday, September 19, 2017

Solid summer ratings for IndyCar on NBCSN

The 2017 Verizon IndyCar Series saw its viewership growing throughout the season. The viewership was down early in the season and the ratings were down for ABC's free-to-air telecasts, yet solid ratings throughout the summer boosted the viewership on NBC's cable channels over the previous years' averages.

The table below shows the viewership in thousands for NBC's cable telecasts.

Total Audience Delivery for NBC's telecasts in 2017: 507,000.

Early 2017 did not look positive for the Verizon IndyCar Series' TV ratings. The ratings for the free-to-air telecasts on ABC were down, as well as the ratings for Long Beach and Phoenix on NBCSN was down. The Honda Indy Grand Prix of Alabama at Barber Motorsports Park was an exception, showing growth of over 60 percent in audience, though it was aided by a NASCAR race having a rain delay.

The Rainguard Water Sealers 600 at Texas Motor Speedway was the first race back on NBCSN after ABC's coverage from Indianapolis and Detroit. The Texas race started a strong streak for IndyCar's TV ratings for the rest of the season; eight of the last nine races had over 500 thousand viewers.

The Honda Indy 200 at Mid-Ohio was the most-viewed IndyCar race on cable in 2017; the live telecast on CNBC had 200 thousand viewers and the tape delayed NBCSN telecast had 576 thousand viewers following a NASCAR race. The most-viewed live telecast was the ABC Supply 500 at Pocono with 618 thousand viewers.

None of the 2017 races could match the most viewed races of the previous two seasons; in 2016 Mid-Ohio had 1.0 million viewers, thanks to the rain delay at a NASCAR race. In 2015 Sonoma had 841 thousand viewers, though the 2015 race took place three years earlier when the football season had not started and there was no NASCAR Cup race that weekend.

Although IndyCar could not achieve its previous top ratings on cable in 2017, the solid ratings since June improved the average audience compared to previous years. The Bommarito Automotive Group 500 at Gateway Motorsports Park was the only race since June with less than 500 thousand viewers as it took place in the same night as the Mayweather-McGregor fight.

While the average audience for the Verizon IndyCar Series on NBC's cable channels grew by eight percent from 2016, the average for those aged between 18 and 49 went down by four percent. Over the full season on ABC and NBC's channels, the 18-49 age group's viewership was down 10 percent. The 18-49 age group made up 22 percent of the IndyCar audience both on NBC's cable channels and on ABC.

The percentage of viewers aged 18-49 is slightly lower for IndyCar than it is for the NASCAR Cup Series or NHRA, for both of which it is around 25 percent. However, IndyCar's open-wheel rival Formula One has over 30 percent of its American viewers aged between 18 and 49. While IndyCar has a slightly higher average audience, F1 has more viewers in the 18-49 age group.

An obvious explanation for the growth of the viewership in the older generations may be that there are fans of Indy car racing that were lost in the split. INDYCAR's aim was to make those lost fans interested in the series again, and the audience growth implies it has succeeded in it. However, there is a younger generation of fans who grew up during the split and were never into Indy car racing. Gaining new fans from the younger generations is the next challenge for INDYCAR.

Gaining young fans is crucial for the long-term future of the series. A series with a good future outlook is also more attractive for sponsors, which in turn will help the series to grow. IndyCar already gets overshadowed by NASCAR in American media; if it can't attract young fans, it will be overshadowed by F1 as well. Then again, if IndyCar could attract young fans like F1 does, it could outnumber NASCAR's Trucks and possibly the Xfinity Series in the 18-49 audience.

Numbers via Awful Announcing, Showbuzz Daily, Sports Media Watch, NBC Sports Pressbox, and Adam Stern on Twitter.

The table below shows the viewership in thousands for NBC's cable telecasts.

|

| Click to enlarge |

Total Audience Delivery for NBC's telecasts in 2017: 507,000.

- Up three percent on 2016 (492,000; excludes the rain-delayed Texas and Pocono races)

- Down one percent on 2015 (510,000)

- Down 11 percent on 2016 (1.28 million; 15 races)

- Down 1.7 percent on 2015 (1.16 million; 16 races)

Early 2017 did not look positive for the Verizon IndyCar Series' TV ratings. The ratings for the free-to-air telecasts on ABC were down, as well as the ratings for Long Beach and Phoenix on NBCSN was down. The Honda Indy Grand Prix of Alabama at Barber Motorsports Park was an exception, showing growth of over 60 percent in audience, though it was aided by a NASCAR race having a rain delay.

The Rainguard Water Sealers 600 at Texas Motor Speedway was the first race back on NBCSN after ABC's coverage from Indianapolis and Detroit. The Texas race started a strong streak for IndyCar's TV ratings for the rest of the season; eight of the last nine races had over 500 thousand viewers.

The Honda Indy 200 at Mid-Ohio was the most-viewed IndyCar race on cable in 2017; the live telecast on CNBC had 200 thousand viewers and the tape delayed NBCSN telecast had 576 thousand viewers following a NASCAR race. The most-viewed live telecast was the ABC Supply 500 at Pocono with 618 thousand viewers.

None of the 2017 races could match the most viewed races of the previous two seasons; in 2016 Mid-Ohio had 1.0 million viewers, thanks to the rain delay at a NASCAR race. In 2015 Sonoma had 841 thousand viewers, though the 2015 race took place three years earlier when the football season had not started and there was no NASCAR Cup race that weekend.

Although IndyCar could not achieve its previous top ratings on cable in 2017, the solid ratings since June improved the average audience compared to previous years. The Bommarito Automotive Group 500 at Gateway Motorsports Park was the only race since June with less than 500 thousand viewers as it took place in the same night as the Mayweather-McGregor fight.

Attracting younger generations IndyCar's challenge

While the average audience for the Verizon IndyCar Series on NBC's cable channels grew by eight percent from 2016, the average for those aged between 18 and 49 went down by four percent. Over the full season on ABC and NBC's channels, the 18-49 age group's viewership was down 10 percent. The 18-49 age group made up 22 percent of the IndyCar audience both on NBC's cable channels and on ABC.

The percentage of viewers aged 18-49 is slightly lower for IndyCar than it is for the NASCAR Cup Series or NHRA, for both of which it is around 25 percent. However, IndyCar's open-wheel rival Formula One has over 30 percent of its American viewers aged between 18 and 49. While IndyCar has a slightly higher average audience, F1 has more viewers in the 18-49 age group.

An obvious explanation for the growth of the viewership in the older generations may be that there are fans of Indy car racing that were lost in the split. INDYCAR's aim was to make those lost fans interested in the series again, and the audience growth implies it has succeeded in it. However, there is a younger generation of fans who grew up during the split and were never into Indy car racing. Gaining new fans from the younger generations is the next challenge for INDYCAR.

Gaining young fans is crucial for the long-term future of the series. A series with a good future outlook is also more attractive for sponsors, which in turn will help the series to grow. IndyCar already gets overshadowed by NASCAR in American media; if it can't attract young fans, it will be overshadowed by F1 as well. Then again, if IndyCar could attract young fans like F1 does, it could outnumber NASCAR's Trucks and possibly the Xfinity Series in the 18-49 audience.

Numbers via Awful Announcing, Showbuzz Daily, Sports Media Watch, NBC Sports Pressbox, and Adam Stern on Twitter.

Tuesday, June 6, 2017

Are IndyCar's ratings on ABC a reason to be worried?

The doubleheader Chevrolet Detroit Grand Prix concluded ABC's coverage of the Verizon IndyCar Series for this season as the remaining nine races will be broadcast by NBC Sports Network. Five races and two qualifying days for the Indianapolis 500 had in total 11.5 million viewers on ABC. That is 11 percent down from 12.9 million last year, and seven percent down from 12.3 million viewers in 2015.

Excluding the Indy 500 and its qualifying, the four regular races had 980 thousand viewers on average on ABC. That is down 16 percent from 1.2 million last year and the same as in 2015. Only the INDYCAR Grand Prix at the Indianapolis road course was up in viewership compared to last year whereas only the Firestone Grand Prix of St. Petersburg had more viewers than in 2015.

There were many positives for INDYCAR from the Month of May. However, the 101st Indianapolis 500 was the lowest-rated 500 with a final rating of 3.4 with 5.5 million viewers, down 12 percent in ratings and nine percent in viewers from last year (3.9 rating, 6.0m viewers). The drop wasn't such a big surprise as last year was the celebrated 100th Running and the local blackout was lifted. However, the 2015 Indy 500 had earned a final rating of 4.2 with 6.5 million viewers, despite the local blackout.

The drop in the Indy 500's American ratings was compensated by increased viewership in Europe, thanks to F1 star Fernando Alonso's participation. The viewership in Alonso's native country Spain averaged at 361,000 viewers with a share of 2.9 percent. That was above F1's Monaco Grand Prix the same day which averaged 212 thousand viewers and 302 thousand a year earlier. In the United Kingdom, the 500 averaged at 129 thousand viewers and a share of 0.91 percent, up 975 percent from 12 thousand a year earlier. The Indy 500 was broadcast on a pay channel in both Spain and the UK.

Declining viewership isn't only IndyCar's problem, in fact NASCAR and NHRA are experiencing even more dramatic drops in viewing figures. Also Formula One suffers from declining viewership worldwide, though in the USA its ratings have improved so far this year.

The Monaco Grand Prix in the Memorial Day weekend earned a 1.0 final rating with 1.4 million viewers. It was the most-viewed F1 race on NBC's channels since the group became the American F1 broadcaster in 2013. Excluding the Indy 500, no free-to-air IndyCar telecast on ABC could match those numbers.

While the difference in the viewership isn't particularly big between F1 and IndyCar, F1 has considerably more viewers aged between 18 and 49 years. 31 percent of the viewers of the Monaco GP were from the 18-49 age group. For the five earlier F1 races this season on NBCSN, the average is 33 percent. Excluding the 500, the four races shown on ABC had only 24 percent of viewers from that 18-49 age group, and on NBCSN the average so far is 23 percent.

The Indy 500 didn't see an increase in the share of viewers aged between 18 and 49 years. The last two years, 22 percent of the 500's viewers have been from that age group, below the average of the other races shown on ABC. That is opposite to NASCAR's flagship race, the Daytona 500, which had 30 percent of its viewers in the 18-49 age group whereas the average for the other races on Fox this year was 26 percent.

Also, while the gap in the viewership of the Indy 500 (5.5 million) and NASCAR's Coca-Cola 600 (4.6 million) was the biggest since 2000 in favor of the 500, they both had the same viewership of 1.2 million in the 18-49 age group. Though a year ago, the Coke 600 had more 18-49 viewers despite the 500 having more viewers in total.

Given that IndyCar and F1 have lots of similarities but also certain differences, a good question is why F1 gets more viewers in the USA, especially in the 18-49 age group.

Formula One is known as the pinnacle of motorsports for a reason. It has the fastest cars for road courses, the F1 cars are technically the most advanced race machines alongside Le Mans Prototypes, and most of the top talent in open-wheel racing are in F1. If anything, F1 is relatively unknown in the USA compared to the rest of the world.

On the other hand, the Verizon IndyCar Series has the fastest race cars in the USA, apart from F1's annual visit to the States. While IndyCar lacks the technical competition of F1, its closer field provides better racing, and ovals add to the versatility of the series. Nine of the 21 full-season cars are driven by Americans whereas there are no American drivers in F1 despite an American team. The F1 races are mostly early in Sunday morning whereas IndyCar races are in the afternoon or evening. And IndyCar offers more chances for American fans to go and see races live.

If I had to make an assumption on why F1 gets more viewers than IndyCar in the USA excluding the 500, I'd say that's because of F1's status as the pinnacle of motorsports. No matter how great racing IndyCar provides, there will always be people who insist on F1's supremacy because it draws most of the open-wheel talent and has the higher levels of engineering.

The 18-49 age group was probably the most impacted by the split of American open-wheel racing. The younger generations of that group were still teens or even kids during the split years. With the American open-wheel racing split in two, F1 may have been the most attractive open-wheel series to start following back then.

Also, the technological skills of the younger generations may be behind F1's popularity in the 18-49 age group. If you follow the international motorsports press, F1 dominates there. Thanks to Internet, you can follow series that don't get much coverage in your local sports news. Probably no other series has so much coverage between the races as F1, making it easy to stay engaged with it.

If there's any major flaw in the Verizon IndyCar Series, I'd say it's the length of the season, or rather the offseason. Hardly any major series in motorsports goes away for half of a year. I get the INDYCAR management's point of avoiding the football season but the long offseason kills the momentum the series had gained during the season. INDYCAR leaves the fans craving for other racing, like NASCAR or F1 that already dominate the media. Even if TV ratings for fall races were hit by football, the longer season would keep fans more engaged with the series.

Alonso's running at Indy generated lots of interest among F1 fans. Given that, I was disappointed the Indy 500 viewership declined also in the 18-49 age group. Maybe Alonso's participation had very little effect on the American viewership of the 500 or maybe it saved it from even bigger of a decline.

I'm not so worried about IndyCar's declines ratings on ABC this year. While the ratings were down on ABC, the three first races on NBCSN have averaged 378 viewers on average, up nine percent from last year and up 15 percent from 2015. Yet the age structure of IndyCar's fanbase is worrying. IndyCar has a smaller part of its viewers in the 18-49 age group than F1 or NASCAR have. It's important IndyCar can attract younger fans to ensure the series' long-term health.

As ESPN, which produces ABC's IndyCar coverage, has laid off their motorsports staff, it seems like INDYCAR will need to find another broadcaster for the races they want to have broadcast free-to-air. ESPN still is under contract of showing five races on ABC in 2018, though the layoffs imply they may give up those rights a year before the contract expires. And anyway, INDYCAR needs to negotiate a new over-the-air broadcast contract for 2019 onwards.

NBC would seem like a logical choice for the over-to-air coverage as they already broadcast 12 races on cable. Broadcasting the full season, NBC might put more effort in promotion than ABC which shows only five races. A single broadcaster might also be more flexible in their choices to show races free-to-air; currently ABC's coverage is centered around the Month of May and the entire second half of the season is on cable on NBCSN.

INDYCAR also needs to have a look into the streaming services. MotoGP already offers a streaming service, and F1 might as well if the contracts with local broadcasters didn't prevent it. If INDYCAR or its broadcast partner offered a streaming service without having to pay for other content, that could be a way to make cord cutters watching the Verizon IndyCar Series. But streaming can't completely replace the TV coverage of the series; streams reach only the hardcore fans, TV enables reaching the big crowd.

Numbers via Awful Announcing, Showbuzz Daily, Sports Media Watch, The F1 Broadcasting Blog, and FormulaTV.

|

| Click to enlarge |

Excluding the Indy 500 and its qualifying, the four regular races had 980 thousand viewers on average on ABC. That is down 16 percent from 1.2 million last year and the same as in 2015. Only the INDYCAR Grand Prix at the Indianapolis road course was up in viewership compared to last year whereas only the Firestone Grand Prix of St. Petersburg had more viewers than in 2015.

There were many positives for INDYCAR from the Month of May. However, the 101st Indianapolis 500 was the lowest-rated 500 with a final rating of 3.4 with 5.5 million viewers, down 12 percent in ratings and nine percent in viewers from last year (3.9 rating, 6.0m viewers). The drop wasn't such a big surprise as last year was the celebrated 100th Running and the local blackout was lifted. However, the 2015 Indy 500 had earned a final rating of 4.2 with 6.5 million viewers, despite the local blackout.

The drop in the Indy 500's American ratings was compensated by increased viewership in Europe, thanks to F1 star Fernando Alonso's participation. The viewership in Alonso's native country Spain averaged at 361,000 viewers with a share of 2.9 percent. That was above F1's Monaco Grand Prix the same day which averaged 212 thousand viewers and 302 thousand a year earlier. In the United Kingdom, the 500 averaged at 129 thousand viewers and a share of 0.91 percent, up 975 percent from 12 thousand a year earlier. The Indy 500 was broadcast on a pay channel in both Spain and the UK.

Declining viewership isn't only IndyCar's problem, in fact NASCAR and NHRA are experiencing even more dramatic drops in viewing figures. Also Formula One suffers from declining viewership worldwide, though in the USA its ratings have improved so far this year.

IndyCar behind F1 in the 18-49 age group

The Monaco Grand Prix in the Memorial Day weekend earned a 1.0 final rating with 1.4 million viewers. It was the most-viewed F1 race on NBC's channels since the group became the American F1 broadcaster in 2013. Excluding the Indy 500, no free-to-air IndyCar telecast on ABC could match those numbers.

While the difference in the viewership isn't particularly big between F1 and IndyCar, F1 has considerably more viewers aged between 18 and 49 years. 31 percent of the viewers of the Monaco GP were from the 18-49 age group. For the five earlier F1 races this season on NBCSN, the average is 33 percent. Excluding the 500, the four races shown on ABC had only 24 percent of viewers from that 18-49 age group, and on NBCSN the average so far is 23 percent.

The Indy 500 didn't see an increase in the share of viewers aged between 18 and 49 years. The last two years, 22 percent of the 500's viewers have been from that age group, below the average of the other races shown on ABC. That is opposite to NASCAR's flagship race, the Daytona 500, which had 30 percent of its viewers in the 18-49 age group whereas the average for the other races on Fox this year was 26 percent.

Also, while the gap in the viewership of the Indy 500 (5.5 million) and NASCAR's Coca-Cola 600 (4.6 million) was the biggest since 2000 in favor of the 500, they both had the same viewership of 1.2 million in the 18-49 age group. Though a year ago, the Coke 600 had more 18-49 viewers despite the 500 having more viewers in total.

Given that IndyCar and F1 have lots of similarities but also certain differences, a good question is why F1 gets more viewers in the USA, especially in the 18-49 age group.

Formula One is known as the pinnacle of motorsports for a reason. It has the fastest cars for road courses, the F1 cars are technically the most advanced race machines alongside Le Mans Prototypes, and most of the top talent in open-wheel racing are in F1. If anything, F1 is relatively unknown in the USA compared to the rest of the world.

On the other hand, the Verizon IndyCar Series has the fastest race cars in the USA, apart from F1's annual visit to the States. While IndyCar lacks the technical competition of F1, its closer field provides better racing, and ovals add to the versatility of the series. Nine of the 21 full-season cars are driven by Americans whereas there are no American drivers in F1 despite an American team. The F1 races are mostly early in Sunday morning whereas IndyCar races are in the afternoon or evening. And IndyCar offers more chances for American fans to go and see races live.

If I had to make an assumption on why F1 gets more viewers than IndyCar in the USA excluding the 500, I'd say that's because of F1's status as the pinnacle of motorsports. No matter how great racing IndyCar provides, there will always be people who insist on F1's supremacy because it draws most of the open-wheel talent and has the higher levels of engineering.

The 18-49 age group was probably the most impacted by the split of American open-wheel racing. The younger generations of that group were still teens or even kids during the split years. With the American open-wheel racing split in two, F1 may have been the most attractive open-wheel series to start following back then.

Also, the technological skills of the younger generations may be behind F1's popularity in the 18-49 age group. If you follow the international motorsports press, F1 dominates there. Thanks to Internet, you can follow series that don't get much coverage in your local sports news. Probably no other series has so much coverage between the races as F1, making it easy to stay engaged with it.

If there's any major flaw in the Verizon IndyCar Series, I'd say it's the length of the season, or rather the offseason. Hardly any major series in motorsports goes away for half of a year. I get the INDYCAR management's point of avoiding the football season but the long offseason kills the momentum the series had gained during the season. INDYCAR leaves the fans craving for other racing, like NASCAR or F1 that already dominate the media. Even if TV ratings for fall races were hit by football, the longer season would keep fans more engaged with the series.

Alonso's running at Indy generated lots of interest among F1 fans. Given that, I was disappointed the Indy 500 viewership declined also in the 18-49 age group. Maybe Alonso's participation had very little effect on the American viewership of the 500 or maybe it saved it from even bigger of a decline.

I'm not so worried about IndyCar's declines ratings on ABC this year. While the ratings were down on ABC, the three first races on NBCSN have averaged 378 viewers on average, up nine percent from last year and up 15 percent from 2015. Yet the age structure of IndyCar's fanbase is worrying. IndyCar has a smaller part of its viewers in the 18-49 age group than F1 or NASCAR have. It's important IndyCar can attract younger fans to ensure the series' long-term health.

The future of IndyCar broadcasting

As ESPN, which produces ABC's IndyCar coverage, has laid off their motorsports staff, it seems like INDYCAR will need to find another broadcaster for the races they want to have broadcast free-to-air. ESPN still is under contract of showing five races on ABC in 2018, though the layoffs imply they may give up those rights a year before the contract expires. And anyway, INDYCAR needs to negotiate a new over-the-air broadcast contract for 2019 onwards.

NBC would seem like a logical choice for the over-to-air coverage as they already broadcast 12 races on cable. Broadcasting the full season, NBC might put more effort in promotion than ABC which shows only five races. A single broadcaster might also be more flexible in their choices to show races free-to-air; currently ABC's coverage is centered around the Month of May and the entire second half of the season is on cable on NBCSN.

INDYCAR also needs to have a look into the streaming services. MotoGP already offers a streaming service, and F1 might as well if the contracts with local broadcasters didn't prevent it. If INDYCAR or its broadcast partner offered a streaming service without having to pay for other content, that could be a way to make cord cutters watching the Verizon IndyCar Series. But streaming can't completely replace the TV coverage of the series; streams reach only the hardcore fans, TV enables reaching the big crowd.

Numbers via Awful Announcing, Showbuzz Daily, Sports Media Watch, The F1 Broadcasting Blog, and FormulaTV.

Subscribe to:

Posts (Atom)